5 ways Gavi has saved lives through innovative finance – and there’s more to come

Gavi’s pioneering use of innovative finance tools has helped countries to protect the lives of millions of people.

- 11 June 2025

- 4 min read

- by Michael Anderson, CEO of MedAccess

If your only tool is a hammer, then everything looks like a nail, so the saying goes. Too often in global health, our first response is to fund a new project with familiar features.

Gavi, the Vaccine Alliance has never been afraid to delve into its toolbox. Instead of finding a problem to fit its existing solutions, it has used creative finance tools to target specific challenges in delivering access to vaccines.

Formed in 2000 as a pooled procurement organisation – an innovative financing tool in itself – Gavi has been brave, taking risks on new financing models and using what it learns to refine and improve.

This is not using innovative finance for the sake of it. Gavi has addressed significant immunisation challenges by thinking creatively and collaboratively. Here are five examples that stand out:

1. Accelerating access to pneumococcal vaccines

Pneumococcal disease is the leading cause of pneumonia. In 2010 it claimed approximately 1.4 million children’s lives. Gavi’s Pneumococcal Advance Market Commitment (AMC) provided manufacturers with an incentive to bring new pneumococcal vaccines to market and make them available at lower prices in Gavi-eligible countries. By offering a top-up to manufacturers using AMC funds, Gavi was able to provide long-term visibility on returns, which encouraged three suppliers into the market. In 2024, UNICEF reported that pneumonia deaths among children had almost halved since 2010 to 725,000.

2. Using the bond markets to protect children’s lives

The International Financing Facility for Immunisation (IFFIm) enables Gavi to access funds for immunisation programmes more quickly while providing investors with a fair long-term return. Often known as ‘vaccine bonds’, early IFFIm issuances enabled Gavi to scale access to pentavalent vaccines, which protect against five deadly diseases. Coverage rates for pentavalent vaccine in Gavi-eligible countries have risen from 0% in 2000 to 81% in 2022. IFFIm has contributed to the procurement of more than 1 billion doses of pentavalent vaccines, which has contributed to a healthy, competitive market for this life-saving tool.

Have you read?

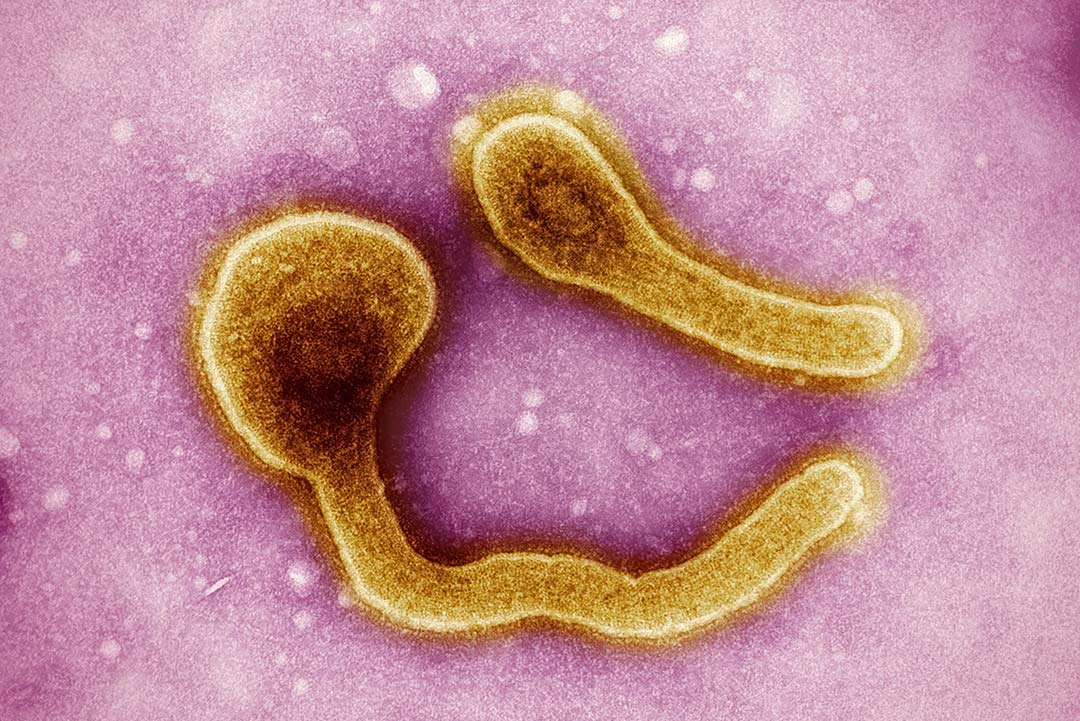

3. Preparing for future Ebola outbreaks

The 2013–2016 Ebola outbreak in West Africa killed more than 10,000 people and plunged communities into fear. Gavi’s efforts to be prepared for future outbreaks led to an Advance Purchase Commitment for an investigational Ebola vaccine, which could be stockpiled for future use, with payments linked to regulatory milestones. The agreement enabled Gavi to deploy the doses on a compassionate use basis ahead of World Health OrganiZation prequalification. In 2019, Gavi expanded its 300,000-dose stockpile to 500,000. Countries are now able to draw down on the stockpile quickly when outbreaks occur.

4. Tackling a global pandemic

At the start of the COVID-19 pandemic, the world was divided into the haves and the have-nots. As vaccines were developed at record pace, people in low- and middle-income countries faced being pushed to the back of the queue. The COVAX Facility was a unique partnership that pooled donor resources to enter into agreements with multiple companies with candidate vaccines. This meant a share of vaccines would be available for COVAX-eligible countries at the same time as in Europe and the US. The first COVAX doses were delivered less than a month after the first person in the UK received a COVID-19 vaccine. But there were challenges ahead. As countries began hoarding vaccines and issuing export bans, supply for COVAX dried up. In spite of this, COVAX delivered 2 billion vaccine doses to 146 economies, saving an estimated 2.7 million lives.

5. Accelerating access to the world’s first malaria vaccine

After being in development for more than 30 years, GSK’s RTS,S malaria vaccine – the first ever to be licensed – was awaiting policy and funding decisions. Continued production of the vaccine antigen was under threat in late 2022 as there was no market for the vaccine if it was not recommended for use in Africa and procured by Gavi. To enable the machines to keep running, Gavi, GSK and MedAccess entered into an innovative financing agreement that saw Gavi fund ongoing production in return for a dose credit and MedAccess guarantee Gavi’s outlay in the event of a negative policy or funding decision. This unique financing agreement ensured doses of the vaccine were ready for deployment in early 2024 following Gavi’s country approvals process.

I’m proud that MedAccess has played a part in supporting Gavi’s use of innovative financing tools. Gavi remains one of the smartest investments in global health. Its programmes have saved more than 18 million lives over the past quarter of a century. Investments in immunisation yield a broad societal return of US$ 54 for every US$ 1 invested. And Gavi has a proud track record on using the right tool for the right challenge. For them, not everything looks like a nail.